Your relationship with a conveyancer begins when an offer is accepted on a property and lasts until the day of completion, when keys are exchanged.

For both buyers and sellers, you must have a property-specialised solicitor or a conveyancer to start the ownership process from one person to another.

A conveyancer is essential for a buyer. They verify the seller’s right to sell and minimise legal risks and complications to protect the buyer’s interests throughout the process, ensuring the buyer will legally own the property.

For a seller, the conveyancer will handle all financial obligations related to the sale – protecting the seller from potential legal issues and complications throughout the process.

But, What Is Conveyancing?

Conveyancing is essentially the legal process that involves preparing and processing legal documents, such as contracts, and registering the transfer with the Land Registry.

The conveyancers themselves are property specialists who are either conveyancing solicitors or licensed conveyancers who act on behalf of their clients to make sure their legal rights and restrictions are clear and fair.

How Long Does Conveyancing Take?

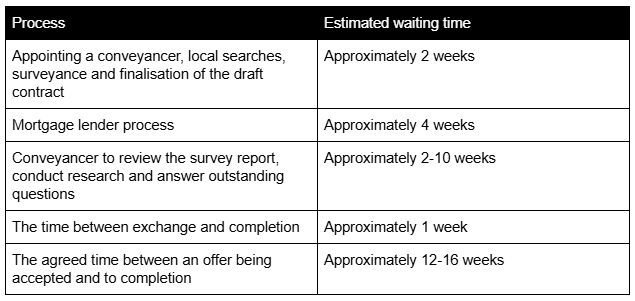

The conveyancing process handles the legal documentation for buying a property, all legal duties, and making sure the buyer becomes a legal owner at the end. The timeline is impacted by waiting times for document exchanges and other external forces like lenders.

This timeline is approximate and depends on case by case; every conveyancing process will be detailed and, most importantly, shared with all parties involved.

Conveyancing Responsibilities For Selling A Property

It is important for a seller to have chosen their conveyancer before the listing is uploaded, as all the pre-check and property information will be requested after any offers are accepted; this is easy when going through an estate agent that has an in-house conveyancer like RMS.

RMS estate agents have a 25-year proven track record in the North East for their detail-oriented process, customer-centric communication, and the highest standard of local knowledge, proven in all sixteen North East based branches of the company.

As a seller, you will be required to fill out a number of questionnaires for your conveyancer to do their inspections, write up and complete the following legal documents required for the sale:

- The TA6 form questionnaire (Seller’s Property Information Form) will ask you about the property boundaries, any ongoing disputes, complaints to you as the seller or a neighbour, any known impactful (proposed or in progress) developments like motorways or railways, building works, council tax band, average utility prices, sewerage and contact details.

- For leasehold properties that you do not own freehold, you need to provide all legal documents, such as the TA7 (leasehold document) or the TA9 (commonhold document).

- The TA10 form will be filled out to detail the fittings and fixtures that will be included in the property sale.

- The TA13 will provide details on how you wish to finalise the sale, for example, how you wish to hand over the keys (either to the estate agent or in person to the buyer), how you will complete the sale by signing and exchanging the final documents, officially closing the mortgage, and transferring ownership to the buyer.

The next steps will be drafting the final contract, which will be sent to the seller for approval and negotiating the terms and conditions of the sale. Negotiation usually includes the date of completion, fixtures and fittings included in the price of the sale, how much extra for other fixtures and fittings the buyer is willing to pay and who will fix any issues raised in the buyer survey / a sale price that reflects the outcome if necessary.

You will receive the buyer’s deposit immediately after the exchange of contracts, but legally, you will still own the property until the completion date set.

On sale day, your conveyancer will receive the outstanding balance of the sale and be able to pay off the mortgage, effectively closing the sale and handing over all legal documents that prove ownership.

Conveyancing Process For Buying A Property

Step 1: Assign a conveyancer to the sale.

The first and most important step in the buying journey is assigning a conveyancer to your sale. If your estate agent is established enough, they will have an in-house conveyancing service when you buy a property from them.

If you’re buying from an estate agent other than RMS, make sure you choose a conveyancing service from a company you know and trust for the most important stage of the buying process.

Your carefully chosen solicitor will undertake ID and Anti Laundering checks as standard, writing to your seller’s solicitor to request all legal documents necessary for the sale, such as the draft contract, the property title and the standard forms necessary.

Step 2: After you’ve chosen the best option for you (RMS), your conveyancer should draft a contract and raise enquiries.

You, as the buyer, should go through all the paperwork requested by the solicitor, including the TA6 form (Seller’s Property Information Form) and the TA10 form (Fittings and Contents Form).

The TA6 form will include any environmental matters to note, insurance history and special requirements, parking arrangements, building safety, noting any hazards or defects, accessibility adaptations or features, and connected services like heat pumps, etc.

The TA10 form then lists items considered part of the property, such as fitted kitchens, bathroom suites, light fixtures, carpets, curtains, and even appliances.

You will also need a record of the leasehold or freehold certification. Knowing how long the lease is for is essential if the property is leasehold. Getting involved with any lease under 60 years old is not recommended.

It is important at this stage to let your conveyancer know as soon as possible if you have any questions or concerns about any of the property information so the process can move forward without any hiccups that cause delays in the buying process.

Step 3: Arrange a Property Survey

This step is not a legal requirement but it couldn’t be recommended more to a buyer as these surveys identify any major problems you may not have picked up.

Surveys are also perfect for buyers still negotiating as they can send a lower offer reflected in the results or even drop out if deemed unsuitable.

Step 4: Property Searches!

As part of the legal conveyancing process, the conveyancer will conduct a thorough search of the property to ensure that no factors should be overlooked when writing and exchanging legal documents.

Where necessary, they will conduct research and provide further legally binding details in any documents in the sale or raise them to the seller to protect you as their client from any nasty surprises.

Step 5: The Mortgage Company Conveyance

If you’re buying with a mortgage company, they will have their own set of steps involved before your mortgage is approved. They essentially ensure the purchase price is reflected in the property you’re buying.

Your mortgage provider will detail all the necessary steps in your legal documentation.

Final Step! Signing Contracts

We recommend you visit the property you are buying before the final exchange of contracts with a list of all fixtures and fittings included and ensure they are in good working order, especially if you have paid extra for them.

Your conveyancer usually exchanges contracts, which involves them reading out the contracts aloud to you to double-check everything and then sending the final document in the post to the seller’s conveyancer.

Once you’ve exchanged the contracts, you are officially in a legally binding contract to buy the property on the agreed fixed date.

This means the seller has handed over the legal rights to you and can no longer change their mind about selling the property.

Then that’s it; you will pick up the keys on the completion date and move into your property!

If you need any more advice or information about this process,

Conveyancers Are Definitely A Necessity!

Conveyancers Are Definitely A Necessity!

Imagine this whole process as a buyer or a seller without a legal professional. It would be a total nightmare. Conveyancers are there to make your life easier and make sure your rights and your assets are protected at every step of the process. Choose carefully who you want to represent you, or even easier, choose an estate agent with an in-house specialist here to have your back every step of the way.

With sixteen branches across the North East, we are here to help. Please select your local branch here: Alnwick, Amble, Ashington, Bedlington, Blyth, Fenham, Forest Hall, Gosforth, Hexham, Jesmond, Morpeth, Ponteland, Ryton, West Denton, Whitley Bay, or Commercial at Head Office.